Each year there are an estimated 6 million auto accidents in the United States. But what happens with your auto insurance after an accident occurs? And how long does a car accident stay on your record as a driver?

It can be intimidating not knowing what will happen after you are in an auto accident. But you’ve come to the right place for answers to those questions.

Continue reading and you’ll learn all about how an auto accident affects car insurance rates, as well as how long an accident will stay on your car accident record.

Importance of Your Driving Record

Every driver knows that your driving record is crucial for a multitude of reasons.

Your driving record is the primary tool that insurance companies will use in order to determine what your car insurance rates will be as well as the cost of your premium.

There are other factors that play into your insurance costs, like your zip code and your credit score. But your driving record is the largest determining factor for what you will be paying.

The more accidents and traffic violations you have on your driving record, the more your insurance will cost you every month.

If you have been in a significant number of accidents or have a lot of violations you may even end up being categorized as a “high-risk” driver.

If that is the case, your insurance company might require that you get non-standard insurance.

Conversely, if you have a clean driving record you might qualify for cheaper rates and discounts as a reward for being a safe driver.

The good news is that even if you have accidents or violations on your driving record, it isn’t forever.

After a certain amount of time (usually 3-5 years) your violations and accidents will drop off and you will have a clean record. At that point, your insurance will no longer be affected.

How Long Does a Car Accident Stay on Your Record?

Any driver with a drivers’ license has a motor vehicle record or MVR. A motor vehicle record catalogs any accidents you may have as well as speeding tickets or other moving violations.

Luckily these incidents won’t stay on your record for eternity. The length of time that they remain on your record depends on how severe the accident or violation was, and the laws of the state that you live in.

Each state has its own Department of Motor Vehicles (DMV), and each DMV has its own policy regarding accidents and violations, and the length of time that they will remain on your driving record.

A lot of states utilize a point system, with certain violations causing you to accrue points. If you accrue too many points your license will be suspended and you will no longer be allowed to drive a motor vehicle.

Take Florida for example. In the state of Florida, speeding will get you 3 points on your driving record. Failure to obey a traffic signal is worth 4 points, and leaving the scene of an accident without providing your information is worth 6 points.

The suspension system for points in Florida works like this:

- 12 points in 12 months

- 18 points in 18 months

- 24 points in 36 months

If you accrue 12 points in a 12-month timespan, you will face a 30-day suspension of your drivers’ license.

If you accrue 18 points in 18 months the penalty is a 3-month suspension of your license, and if you accrue 24 points in 36 months your license will be suspended for an entire year.

So How Long Does an Accident Affect Your Insurance?

While an accident in recent years can still affect your insurance rates, at some point it will fall off of your record and no longer be taken into consideration by insurance companies.

The majority of insurance companies will look at the past 5 years of your driving record, so an accident 6 or more years ago would not be a factor in your insurance premium.

There are some insurance companies that will even look at just the past 3 years of your driving record.

Additionally, even with accidents or violations on your driving record, some car insurance companies will reward you for good driving over an extended period of time and your rates will begin to drop.

Depending on what state you live in. There may be laws about the kinds of accidents or violations that insurance companies can consider. As well as the length of time they are allowed to go back.

Does a No-Fault Accident Affect Your Insurance?

In the majority of cases, getting in a car accident that is not your fault will not increase your monthly auto insurance payments. This is due to the insurance of the at-fault driver handling the costs of the damages and medical bills.

As long as your insurance company doesn’t give you any money for handling the claim. Then your insurance rates will not change at all and you will not be punished.

You are at risk of your insurance increasing after a no-fault accident if you have a record of car accidents that were your fault. In these instances, drivers can see an increase in their payments of up to 10%.

If your rate does increase there are some ways that you can try to lower it. Bundling your insurance policies can save you money through discounts that your insurance provider may offer as an incentive.

Raising your deductible is another option for getting lower monthly payments if your insurance increases.

If you aren’t comfortable with those options you can always shop around for a better policy through a different provider.

Knowledge Is Power

The more knowledge you have the better off you are. Knowing the answer to questions like, “How long does a car accident stay on your record?” can save you time, stress, and money.

Read here for more helpful tips that will make your driving experience cheaper and stress-free.

CONTACT A TAMPA AUTO ACCIDENT ATTORNEY

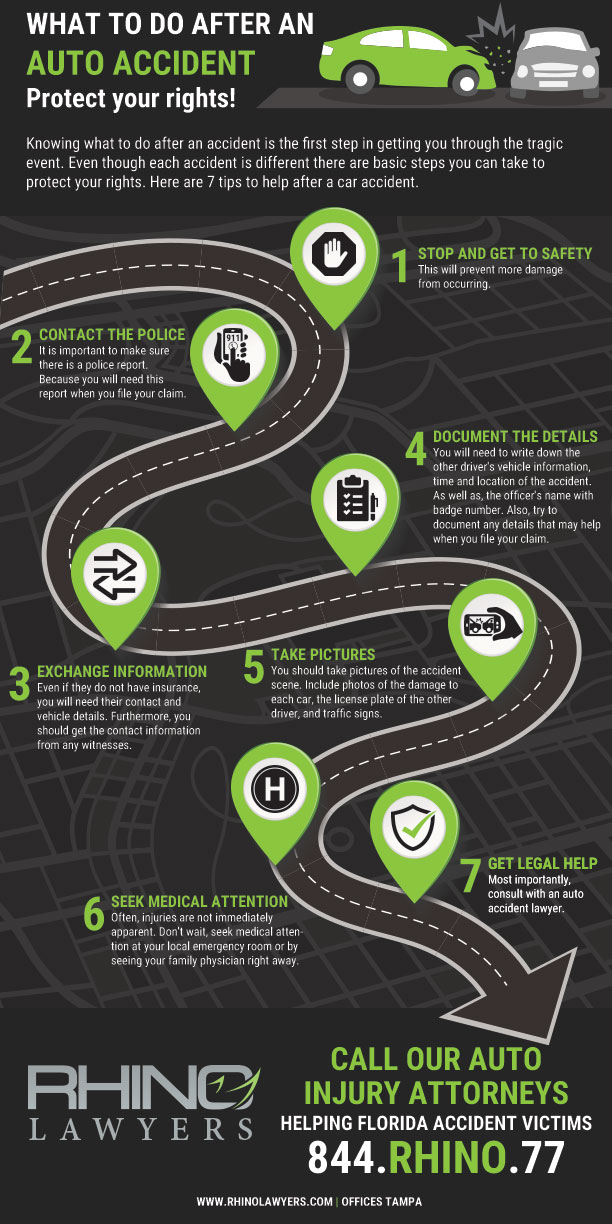

In short, after a car accident, you may not know your rights. Above all, don’t struggle through the process alone. Actually, our personal injury team is here to help you with any legal needs you might have regarding your accident.

Lastly, let RHINO Lawyers answer your questions and review the facts of your case with a Free Consultation. So, get started by completing the “Free Instant Case Evaluation” or by calling us any time, day or night, at 844.RHINO.77.