Imagine this:

You’re driving down the road, completely focused, with both hands on the wheel, going the speed limit, and suddenly, someone rear-ends you. You sustain a neck sprain from the accident, so you file an injury claim with the at-fault driver’s insurance company.

It’s evident you didn’t do anything wrong in this situation, but the insurance company pulls your driving record and sees it’s not so squeaky clean. In fact, on paper, you look like the one who is a bad driver.

Can the insurance company use your driving record against you when you file a claim?

Unfortunately, they often can.

So keep reading as we dive into this topic, and you learn exactly how your driving record can impact an insurance claim.

Who Is Entitled to Compensation From an Injury Claim?

Before discussing how a poor driving record can affect an injury claim, you should know that if someone else injures you in a car accident, you are legally entitled to compensation.

You should never let blemishes on your driving record stop you from filing a personal injury claim against the at-fault party. First, however, you want to hire some legal help when filing a claim.

Although your driving record alone cannot prevent you from receiving compensation, it can lower the amount you receive from the insurance company for your claim. Neither party can use evidence of prior convictions of criminal-based driving offenses to prove guilt. Examples of these convictions include:

- Careless driving

- Driving with an expired or suspended license

- Fleeing the scene of an accident

- Hit and run

- Illegal drag racing

- Vehicular manslaughter

But, attorneys can use your driving record to doubt your credibility and testimony. Thus, hiring a lawyer to help you with your claim is the best way to get the compensation you deserve.

Insurance companies use many tactics to pay less money on claims, so you want someone in your corner fighting against them and for what you are owed for your pain and suffering.

How Insurance Companies Try to Use Your Driving Record Against You

If you have one parking ticket or a single moving violation on your driving record, it won’t be enough for the insurance company to try to use it against you.

But suppose you have multiple tickets for distracted driving, several speeding tickets, or a conviction for a criminal-based driving offense. In that case, they may try to establish a pattern of poor driving.

If they can show you are a reckless driver, they may try to say you were actually the at-fault driver in the accident. They can use this information to counter your claim and deny you financial compensation.

Remember, you’re only entitled to compensation from an at-fault party.

Based on your driving record, they may be unable to outright blame you entirely for the accident. But they can still try to allege you were partially at fault.

Being partially at fault would undervalue your claim so that the insurance company would pay you less. Every state has negligence laws that prevent you from receiving part or all of your compensation if you were partially to blame for the accident.

The insurance company may try to use your driving history to establish some fault and paint you as a negligent driver. Then, they wouldn’t have to pay as much in compensation to you for your injuries.

Pre-Existing Injuries

Aside from trying to establish a pattern of poor and negligent driving to reduce your compensation, the insurance company may also try to prove your injuries were actually from a prior accident.

For instance, if your driving record shows you were in a previous accident, the insurance company may try to use that as a way to state that your current injuries are just pre-existing.

If they successfully prove this, they could prevent you from receiving any money. This is because pre-existing conditions are not compensable in personal injury claims.

However, if you did have a prior accident, but this most recent accident aggravated pre-existing injuries, you can still receive compensation. You would need the assistance of an attorney to help you collect proper evidence to prove the accident worsened your condition.

Additionally, the insurance company cannot claim your injuries wouldn’t have been so bad if you didn’t already have a pre-existing condition. So they have to accept your condition as it is. This is the eggshell skull rule.

Can Your Driving Record Help You in an Injury Claim?

Your driving record isn’t all bad news for your injury claim.

While the insurance company may try to use a poor driving record against you, it can benefit you in your lawsuit if you have a clean or primarily spotless record.

If the insurance company tries to paint you as a negligent driver or establish fault, your lawyer can use your clean record to demonstrate you’re a careful driver. This could benefit and strengthen your claim.

Further, you can introduce the other driver’s record into the court. If the at-fault driver has a history of car accidents or moving violation tickets, this could help your case. Your lawyer can use the other driver’s record to establish a pattern of negligent driving.

This may take any fault away from you and strengthen how much compensation you are entitled to receive.

If one party wants to submit driving records to the court, it’s best to present both drivers’ records to establish fault better. Again, it will work in your favor if you have a history of being a safe driver.

Hire a Lawyer for Your Personal Injury Claim

If you’ve recently been in an accident and want to file an injury claim, you must hire a lawyer first. It’s the best way to ensure you receive the compensation you deserve.

Contact us at RHINO Lawyers to speak with an attorney today. We’ll offer free advice to you now!

CONTACT A TAMPA AUTO ACCIDENT ATTORNEY

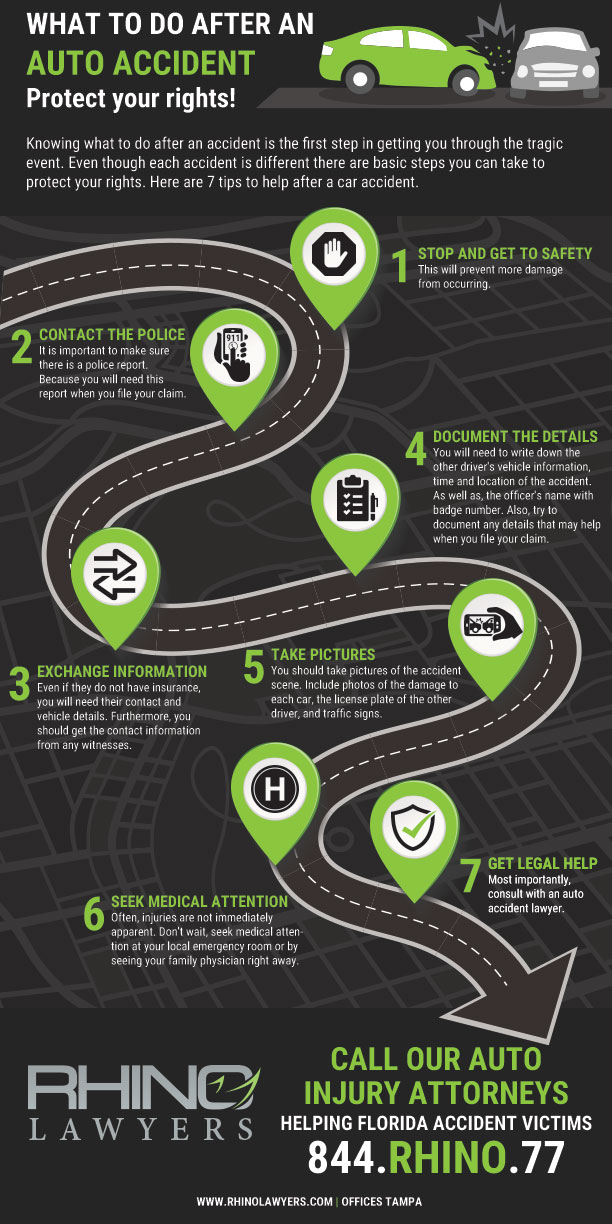

In short, after a car accident, you may not know your rights. Above all, don’t struggle through the process alone. Actually, our personal injury team is here to help you with any legal needs you might have regarding your accident.

Lastly, let RHINO Lawyers answer your questions and review the facts of your case with a Free Consultation. So, get started by completing the “Free Instant Case Evaluation” or by calling us any time, day or night, at 844.RHINO.77.