Motorcycling offers a unique thrill and freedom that few other forms of transportation can match. Whether you’re a seasoned rider or a newbie, understanding motorcycle coverage is essential to protecting yourself, your bike, and others on the road. Here’s an in-depth look at what you really need to know about motorcycle insurance.

Understanding the Basics of Motorcycle Insurance

Motorcycle insurance, like auto insurance, is designed to offer financial protection in the event of an accident, theft, or other incidents. However, there are nuances specific to motorcycles that make them distinct. The fundamental components of motorcycle insurance include:

- Liability Coverage

- Bodily Injury Liability: This covers medical expenses, lost wages, and legal fees if you’re at fault in an accident that injures someone else.

- Property Damage Liability: Pays for repairs or replacement of others’ property that you damage in an accident.

- Collision Coverage

- Covers the cost of repairing or replacing your motorcycle if it’s damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage

- Protects against non-collision-related incidents such as theft, vandalism, natural disasters, and animal collisions.

- Uninsured/Underinsured Motorist Coverage

- Provides protection if you’re involved in an accident with a driver who has insufficient or no insurance.

- Medical Payments Coverage

- Pays for medical expenses incurred by you and your passengers, regardless of fault.

- Personal Injury Protection (PIP)

- Similar to medical payment coverage but more extensive, PIP can cover lost wages and other expenses in addition to medical costs.

Why Motorcycle Insurance is Crucial

Unlike cars, motorcycles offer minimal protection to riders in the event of an accident. The exposed nature of motorcycling significantly increases the risk of severe injury or death. This inherent risk makes adequate insurance coverage not just advisable but essential.

- Financial Protection: Medical bills and repair costs can quickly escalate following an accident. Without insurance, you might face substantial out-of-pocket expenses.

- Legal Requirements: In most states, carrying a minimum amount of liability insurance is mandatory. Riding without insurance can lead to fines, license suspension, or worse.

- Peace of Mind: Comprehensive coverage ensures that you’re protected from various risks, allowing you to enjoy your ride with confidence.

Key Factors Influencing Motorcycle Insurance Premiums

Several factors affect the cost of your motorcycle insurance premiums:

- Type of Motorcycle

- Sport bikes, for instance, are typically more expensive to insure due to their high performance and associated risk of accidents.

- Riding Experience and Record

- Experienced riders with clean records usually enjoy lower premiums compared to new riders or those with a history of accidents or violations.

- Age and Gender

- Younger riders and male riders often face higher premiums due to statistically higher risk factors.

- Location

- Urban areas with higher traffic volumes and theft rates generally lead to higher insurance costs.

- Coverage Limits and Deductibles

- Higher coverage limits and lower deductibles increase premiums, while lower limits and higher deductibles reduce them.

- Usage

- If you use your motorcycle for commuting or long-distance travel, you may face higher premiums compared to occasional recreational use.

Additional Coverage Options

While standard coverage forms the backbone of your motorcycle insurance, there are additional options that can provide extra protection:

- Custom Parts and Equipment Coverage

- Many riders customize their motorcycles with expensive parts and accessories. This coverage ensures those additions are protected.

- Roadside Assistance

- Offers services like towing, battery jump-starts, and flat tire repairs, which can be invaluable during a breakdown.

- Trip Interruption Coverage

- Covers expenses related to lodging, food, and transportation if your bike breaks down far from home.

- Trailer Coverage

- If you transport your motorcycle using a trailer, this coverage protects against damage to the trailer.

- Rental Reimbursement

- Pays for a rental vehicle if your bike is being repaired after an accident.

Tips for Choosing the Right Motorcycle Insurance

- Assess Your Needs

- Consider how often and where you ride, the value of your motorcycle, and your financial situation to determine the coverage you need.

- Compare Quotes

- Shop around and get quotes from multiple insurers. Each company evaluates risk differently, leading to varied premium costs.

- Understand Policy Details

- Read the fine print and understand what is covered and what is not. Pay attention to exclusions, coverage limits, and deductibles.

- Look for Discounts

- Many insurers offer discounts for things like completing a motorcycle safety course, being a member of a motorcycle association, or bundling with other insurance policies.

- Review and Update Regularly

- Your insurance needs may change over time. Review your policy annually and adjust coverage as necessary.

Common Myths About Motorcycle Insurance

- Myth: Motorcycles are Cheap to Insure

- Fact: While some motorcycles may have lower premiums, factors like the type of bike, riding history, and location can make insurance expensive.

- Myth: My Auto Insurance Covers My Motorcycle

- Fact: Auto insurance policies do not cover motorcycles. You need a separate motorcycle insurance policy.

- Myth: Comprehensive Coverage is Too Expensive

- Fact: Comprehensive coverage offers crucial protection against theft and non-collision damage, and its cost can be manageable with the right deductible.

- Myth: Older Bikes Don’t Need Full Coverage

- Fact: Even older motorcycles can be expensive to repair or replace. Comprehensive and collision coverage can still be beneficial.

Legal Considerations and Requirements

Understanding the legal requirements for motorcycle insurance in your state is critical. Each state has its own minimum liability coverage requirements. Additionally, some states require:

- Helmet Laws: Many states have mandatory helmet laws that affect insurance claims and rates.

- Proof of Insurance: You must carry proof of insurance when riding. Failure to present it can result in fines or penalties.

- No-Fault Insurance: In states with no-fault insurance laws, your insurer pays for your medical expenses regardless of fault.

Knowing Your Motorcycle Coverage Options Is Important

Motorcycle coverage is more than just a legal requirement; it’s a vital safeguard for your financial and physical well-being. With the proper coverage, you can protect yourself, your bike, and others on the road. By understanding the various types of coverage, the factors influencing premiums, and the additional options available, you can make informed decisions that ensure you’re adequately protected. Ride safely and enjoy the freedom of the open road, knowing you have the right motorcycle insurance coverage in place.

For personalized legal advice or assistance with motorcycle insurance claims, feel free to reach out to RHINO Lawyers, your trusted partner in navigating the complexities of motorcycle insurance and legal matters.

CONTACT A TAMPA Motorcycle ACCIDENT ATTORNEY

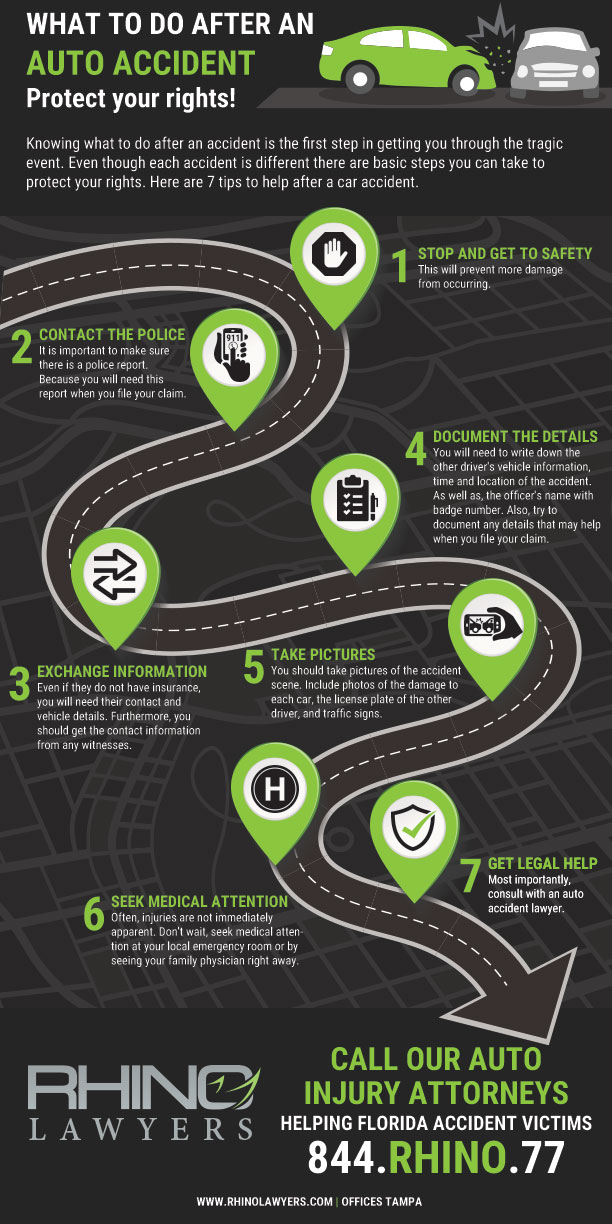

In short, after a motorcycle accident, you may not know your rights. Above all, don’t struggle through the process alone. Actually, our personal injury team is here to help you with any legal needs you might have regarding your accident.

Lastly, let RHINO Lawyers answer your questions and review the facts of your case with a Free Consultation. So, get started by completing the “Free Instant Case Evaluation” or by calling us any time, day or night, at 844.RHINO.77.