In some states, car insurance premiums rose by as much as 40% (CNBC). When you’re involved in an accident, dealing with the aftermath can be as overwhelming as the incident. In fact, working with an insurance adjuster can be one of the most complex and confusing parts of the auto claims process.

It’s essential to remember that auto insurance adjusters represent their employers’ financial interests. Read on to learn about some of the secrets insurance adjusters often keep hidden and the post-accident advice you need to succeed.

1. Your Claim Value May Be Higher Than They Initially Offer

Insurance adjusters often present a low initial settlement offer, hoping you’ll accept it quickly. This tactic is rooted in their goal to minimize payouts. What they won’t tell you is that the first offer is rarely their best.

Evaluating your damages, medical expenses, lost wages, and more is crucial for ensuring you receive fair compensation. Learning how to negotiate can significantly impact the outcome of your claim.

Don’t accept the first offer without consulting an attorney or conducting your research on the value of your claim.

2. You’re Not Required to Give a Recorded Statement

Many adjusters request a recorded statement under the guise of needing your account to process the claim. What they won’t mention is that anything you say can be used to reduce your settlement. Even so-called innocent comments, like saying you “feel fine,” might be misconstrued.

3. They May Delay the Process Intentionally

Adjusters sometimes use delay tactics to frustrate claimants into accepting lower settlements or abandoning their claims altogether. They may drag their feet when returning calls, requesting additional paperwork, or scheduling evaluations. Delays are especially harmful if you’re relying on a settlement to cover medical bills or repair costs.

Insurers benefit from delaying settlements because it may reduce their payout liability. Persistent follow-up and legal counsel can help expedite the process.

4. They Might Downplay the Role of a Lawyer

Insurance adjusters are often wary of claimants who seek legal advice. They may discourage you from hiring an attorney, suggesting it will complicate the process or take longer to resolve your claim. The reality is that attorneys can often secure much higher settlements than you could on your own.

5. Your Policy Might Cover More Than You Think

Insurance adjusters rarely volunteer information about additional benefits you may be entitled to under your policy. The following is often buried in fine print:

- Coverage for rental cars

- Towing services

- Replacement vehicles

Review your insurance policy thoroughly or ask your agent directly about all applicable coverages before accepting an offer.

6. They May Challenge Medical Costs

Are you curious about other insurance adjuster secrets?

After an accident, medical expenses can pile up quickly. Insurance adjusters may question the necessity or reasonableness of certain treatments to reduce the amount they have to pay. They might suggest that some procedures are unrelated to the accident or unnecessary altogether.

7. They Won’t Reveal All Liable Parties

In some cases, multiple parties may share responsibility for an accident, such as other drivers, vehicle manufacturers, or even municipalities responsible for road maintenance. Insurance adjusters may not point out other avenues for compensation, as it’s not in their interest to encourage a thorough investigation.

Consulting with a legal expert can help identify all potentially liable parties, ensuring you receive maximum compensation.

8. They Use Specialized Software to Minimize Settlements

Insurance companies often rely on software to calculate claim values. These programs consider factors like vehicle damage, injury severity, and geographical location. However, the algorithms are designed to benefit the insurer, often undervaluing claims in subtle ways.

Challenge settlement amounts if they seem too low, and request detailed explanations of how the amount was calculated.

9. You Have Time to File Your Claim

Adjusters may pressure you to settle quickly, implying that waiting could jeopardize your case. In truth, most jurisdictions allow claimants several years to file claims, depending on the statute of limitations. Rushing could lead to accepting less than you’re owed.

When it comes to post-accident advice, take the time to gather evidence and understand your rights. You should also consult professionals before making big decisions.

10. Your Personal Information Is Valuable to Them

Adjusters are skilled at gathering information subtly during conversations. They may ask seemingly unrelated questions about your job, financial situation, or personal habits to gauge how desperate you might be for a settlement.

It’s worth following hidden insurance facts. For instance, provide only necessary information and avoid discussing your financial situation or urgency for a payout.

11. You Can Appeal a Denied Claim

If your claim is denied, it’s not necessarily the end of the road. Adjusters may not inform you that you have the right to dispute their decision, often through internal appeals or external arbitration.

Do you want a claim settlement tip? Get a written explanation for any denial. From there, gather supporting evidence to strengthen your appeal.

12. Pre-existing Conditions Are Not Grounds for Denial

Adjusters may argue that pre-existing conditions contributed to your injuries, using this as leverage to lower your payout. However, if an accident aggravated an existing condition, you’re entitled to compensation for the worsened state.

Provide medical records that demonstrate how the accident impacted your condition and solicit expert opinions if necessary.

13. They Prioritize Profit Over Fairness

At the end of the day, insurance adjusters are employees of a for-profit company. Their primary responsibility is to protect the company’s bottom line. While they may seem empathetic, their goal is often to settle claims for as little as possible.

Be sure to stay informed, organized, and proactive. Doing this ensures you’re treated fairly throughout the auto claims process.

Auto Insurance Adjusters Are Not to Be Trusted

By knowing what to look out for, you can avoid being tricked by auto insurance adjusters.

You can always depend on RHINO Lawyers. Our team has dealt with auto insurance adjusters and other people trying to exploit hard-working Americans. We’ve fought to win almost $100,000,000 for our injured clients.

Would you like claim settlement tips? If so, be sure to reach out to RHINO Lawyers and schedule a no-strings-attached consultation.

CONTACT A TAMPA AUTO ACCIDENT ATTORNEY

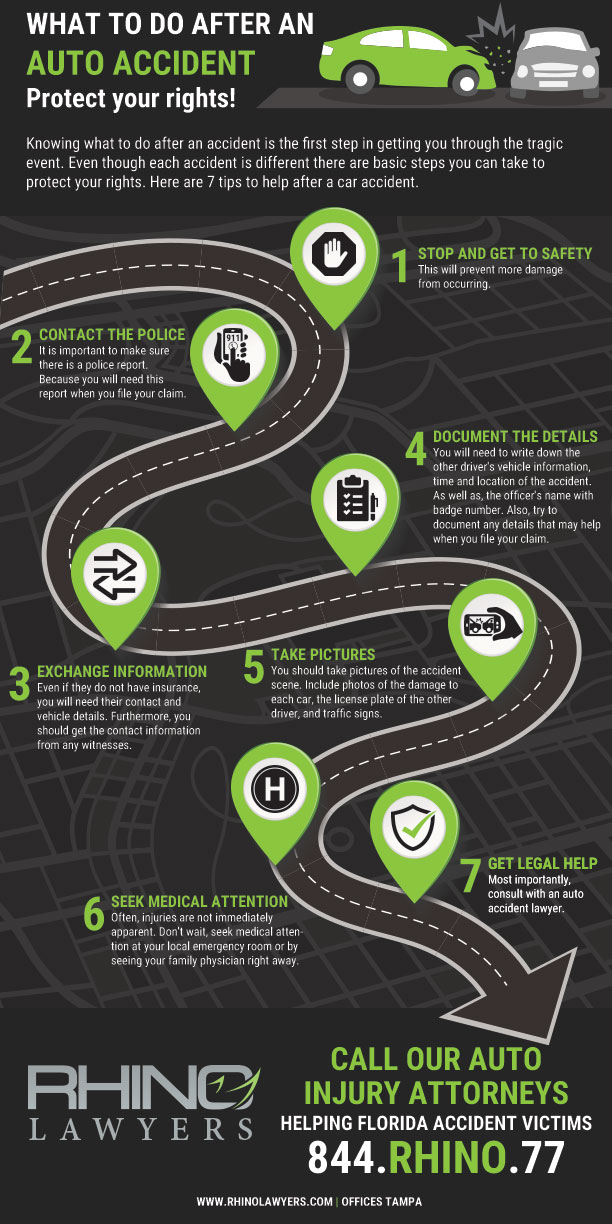

In short, after a car accident, you may not know your rights. Above all, don’t struggle through the process alone. Actually, our personal injury team is here to help you with any legal needs you might have regarding your accident.

Lastly, let RHINO Lawyers answer your questions and review the facts of your case with a Free Consultation. So, get started by completing the “Free Instant Case Evaluation” or by calling us any time, day or night, at 844.RHINO.77.