It might surprise you that around 12.6% of drivers have no auto insurance. It’s true, though. Many people drive without coverage.

Auto insurance comes in many forms, but you’ll pay more for full coverage than liability-only insurance. However, a full-coverage policy provides more protection, so many people choose these policies for the added coverage.

If you recently had an auto accident, learning what full coverage offers might be a vital fact to your case. Therefore, you should learn.

This guide explains full coverage insurance, which might help you learn more about your coverage and rights after a car accident.

It Includes Liability Coverage

A full coverage car insurance policy comes with multiple types of coverage, including liability. Liability coverage is a basic form of coverage that protects you against damages you cause to others.

For example, if you fail to stop at a stop sign and collide with a driver, you’re responsible for the damages the other driver encounters. Your auto liability coverage pays these expenses if you have auto insurance.

Liability insurance provides compensation for several things, including the following:

- Damages to the person’s car

- Medical bills

- Lost wages

When you’re the victim of an accident, the at-fault driver’s liability coverage pays for your damages, assuming they have auto insurance. The downside is that many drivers don’t have insurance, even though it’s required by law.

If the person who caused the accident has liability insurance, you can file a claim with their insurance provider for your damages. If they don’t have insurance, you’ll need a lawyer to settle the claim.

Full-Coverage Covers Collisions

Full-coverage vehicle insurance also covers collisions. Collision protection is one unique aspect of a full-coverage policy, as it protects your vehicle, while liability covers other cars.

People with vehicle loans must carry collision coverage, as their lenders require it. However, you don’t need a loan to add collision coverage to your plan. You can add it to any plan for coverage on any vehicle you own.

The benefit of collision coverage is that it provides compensation for your vehicle even if you cause an accident. In other words, you won’t have to rely on filing a claim with someone else’s insurance policy.

Collision coverage has exclusions with the damage it covers. For example, if you hit an animal while driving, collision coverage might not cover the accident.

In most cases, a driver’s collision coverage compensates them for vehicle damages, medical bills, and other damages. Collision coverage is not the insurance that provides compensation to a car accident victim, though.

One thing to note is that you should always seek medical help after an accident, whether you or someone else caused it. You may want to consider some common symptoms of car accident injuries to know if you need help.

Seeking help right away helps connect the injuries you have to the accident.

It Also Covers Other Causes of Damage

When referring to full-coverage insurance, you should know about another coverage type to expect. This type is called comprehensive car insurance coverage.

So, how is comprehensive different from collision?

First, comprehensive doesn’t cover collisions with other vehicles. Instead, it covers collisions with animals, but that’s not all.

Comprehensive insurance covers many other forms of damage you might experience, including the following:

- Theft

- Fire

- Hail

- Vandalism

- Wind

- Storm

A car might encounter dents, scratches, and broken windows from high winds causing a tree to fall on it. If so, your comprehensive coverage protects you.

Another driver’s comprehensive policy wouldn’t offer compensation to you if that person caused a collision with your car.

Full-Coverage Comes With Underinsured and Uninsured Coverage

You can fully protect a vehicle through full-coverage insurance because it includes a couple of other coverage types that you might need. Here are the two types:

Uninsured Motorist Coverage

First, having full coverage means that you have coverage for accidents with uninsured drivers. By now, you might understand how the at-fault driver’s insurance covers your damages, but some drivers don’t have insurance.

When a driver doesn’t have auto insurance, you might find yourself in a precarious position. After all, what do you do to recover the damages the other driver is responsible for?

Well, one option is to file a claim with your uninsured motorist coverage insurance. This insurance type is for this particular situation, and that’s its only purpose. It protects you from drivers who don’t follow the law.

Underinsured Motorist Coverage

Secondly, your full coverage policy should also include underinsured motorists. This coverage works like uninsured motorist coverage, but it’s for situations when at-fault drivers don’t have enough insurance.

For example, if an at-fault driver has a minimum coverage plan, it might not cover all your damages. If this happens, you can use your underinsured coverage to receive the rest of the money you should receive.

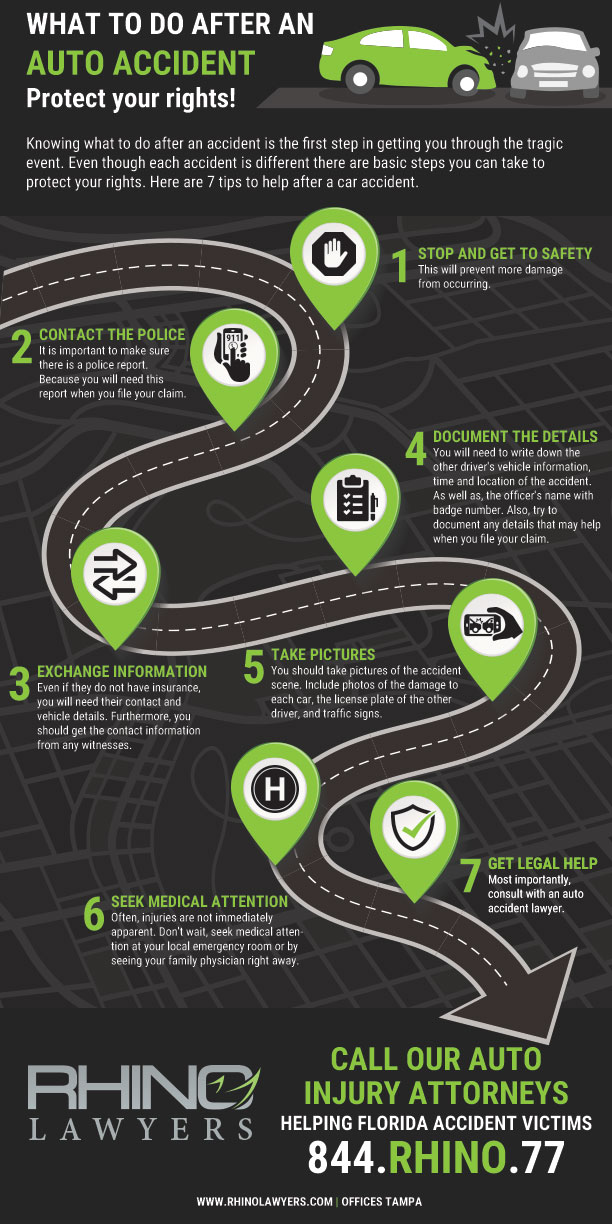

Your Rights After a Car Accident

Understanding how full coverage insurance works is helpful if you ever need to file a claim. It’s especially helpful if someone else causes an accident that leaves you with damages.

If you’re a car accident victim, you might wonder what your rights are afterward.

First, you have the right to seek compensation from the other driver. Secondly, you have the right to seek compensation from your insurance provider.

Third, you have the right to hire a car accident lawyer for help. A car accident lawyer reviews the case and offers the best advice.

If you hire a lawyer, you’ll have someone fighting for you, and you might receive more compensation by handling it this way.

Speak With an Attorney About Your Accident and Coverage

You can fully protect yourself by purchasing a full-coverage auto insurance policy. Your policy won’t stop accidents from occurring, but it can give you peace of mind after one happens.

If you need legal advice about a recent accident, contact RHINO Lawyers. We would love to hear from you, and we offer services in Lakeland and Tampa, FL.

CONTACT A TAMPA AUTO ACCIDENT ATTORNEY

In short, after a car accident, you may not know your rights. Above all, don’t struggle through the process alone. Actually, our personal injury team is here to help you with any legal needs you might have regarding your accident.

Lastly, let RHINO Lawyers answer your questions and review the facts of your case with a Free Consultation. So, get started by completing the “Free Instant Case Evaluation” or by calling us any time, day or night, at 844.RHINO.77.